Beyond numbers: the role of finance in ESG reporting

Last updated: 10th July 2024. Please be aware the ESG regulatory landscape may have changed since this article was written.

As the UK Government plans to release its Sustainability Disclosure Standards (UK SDS) by Q1 2025, many organisations are being prompted to rethink how they measure, track, report, and communicate their sustainability initiatives to stakeholders. Full mandatory disclosure is already required for approximately 50,000 large and listed companies operating in the EU since 1 January 2024, under the Corporate Sustainability Reporting Directive (CSRD). The UK will be following suit and companies will be expected to apply the standards to their 2024 accounting cycle, enabling investors to see information when reports are published in 2025.

Traditionally, Environmental, Social, and Governance (ESG) reporting is managed by dedicated CSR or sustainability teams. However, an increasing number of organisations are choosing to integrate ESG with financial reporting, placing (at least partly) the responsibility on the office of Finance.

Why?

- Companies are recognising the importance of corporate sustainability in driving long-term value creation for investors.

- The UK SDS will use the IFRS® Sustainability Disclosure Standards as a baseline to help investors to compare information between companies.

- Aligning ESG reporting and financial reporting provides a more comprehensive view of corporate performance.

- Finance teams already apply the same principles in data governance, control, and accuracy to financial reporting, so are well placed to extend this role.

In this blog, we explore why Finance teams are uniquely positioned to take on the responsibility of ESG reporting, and their crucial role in ensuring your organisation fulfils its obligation to disclose scope 1 & 2 information and is preparing for scope 3.

How are ESG reporting and financial reporting connected?

Historically, organisations primarily focused on financial reporting disclosures to update stakeholders on a company's financial health, performance, and future prospects. But recently, there has been an exponential growth in demand for disclosure of ESG factors, such as carbon emission, diversity statistics and executive compensation. As of 2023, 90% of FTSE100 companies only work with suppliers that share ESG credentials, highlighting how ESG performance even down the supply chain has evolved as a way of evaluating a company’s long-term sustainability and resilience.

At their core, ESG and financial reporting share a common goal: to provide stakeholders with meaningful insights backed up by data, enabling them to make informed decisions. Therefore, it makes good business sense that organisations should seek to integrate ESG metrics into financial reporting frameworks. Not only will this paint a more complete picture of overall performance, risks, and opportunities, but integrating financial and non-financial information into a single cohesive report gives stakeholders a comprehensive understanding of an organisation's value creation over time.

Defining the role of Finance in ESG Reporting

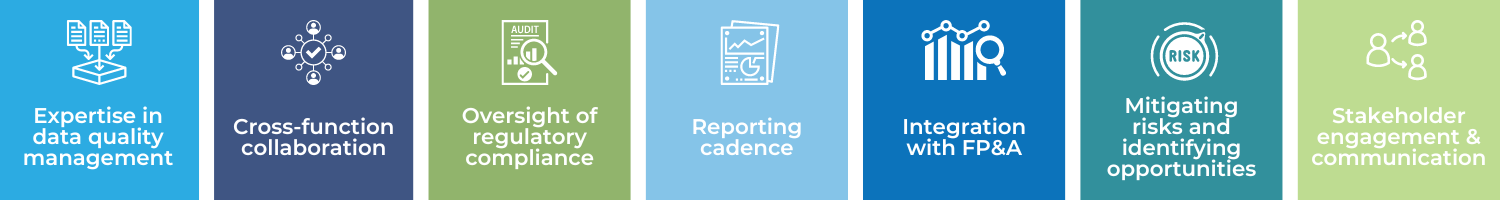

As ESG reporting requires the same level of governance, control, accuracy and auditability needed for financial reporting, Finance teams are well-placed to take on this additional responsibility for the following reasons:

Expertise in data quality management

Given their expertise in financial data management, the office of Finance is well-equipped to handle the complexities of ESG data. Financial controllers are skilled at collecting and consolidating large amounts of financial information from across the organisation in a consistent and controlled format to ensure robust statutory reporting. Requiring information from a wide range of sources, such as HR, operations and upstream/downstream the supply chain, ESG reporting is just as data intensive. Finance teams are ideally positioned to extend their capabilities to merge financial information and non-financial ESG metrics that are frequently more granular and varied, such as carbon emissions, energy consumption, percentage of waste recycled, employee turnover rates, diversity statistics, board composition, and ethical labour practices.

In ESG data management, there also needs to be some consideration given to data security and governance – where does central ownership and responsibility of data lie within your organisation? Who can view and transform data? What controls, validations and consistency checks are in place? ESG data needs to be treated with the same rigor and governance as financial data, and the solution is to integrate new workflows into existing processes and systems where those controls and security measures are already in place.

Cross-function collaboration

Consolidating ESG data can often be a challenge as it is usually housed in disparate systems across multiple business entities and locations. This is especially the case where ESG is not already embedded in business processes and where data is siloed within departments. However, for many organisations Finance is already integrated with operational processes across the organisation, such as HR, Sales, Procurement & Production. Through integrations with internal data sources and ERP systems, Finance teams could extend data collection and consolidation practices to non-financial metrics, ensuring they have ESG data at their fingertips.

Oversight of regulatory compliance

ESG reporting is subject to a growing number of regulatory requirements and guidelines and the same level of governance, control, accuracy and auditability needed for financial reporting will be required for ESG. The office of Finance, with its heavy focus on regulatory compliance and risk management already fully understand how to drive control and accuracy in financial reporting to ensure financial statements and records are transparent and auditable. They are uniquely positioned to weave ESG into existing reporting processes as an extra reporting layer and align with the relevant frameworks and standards, such as IFRS S1 and S2, CSRD and GRI.

Reporting cadence

Normally, financial reporting cycles are completed, annually, quarterly, and monthly. For many companies, ESG disclosures are only reported annually under current regulatory requirements. However, as access to data improves and advances in technology make real-time emissions data a possibility, it is highly likely that ESG disclosures are going to be expected more frequently, which would align with existing financial reporting cycles. Organisations will be responsible for adhering to any new regulatory requirements in the same way they are responsible for making sure that their financial reporting is compliant. To achieve true reporting cadence, ESG disclosures should be reported using the same structure and rigour used for reporting against a chart of accounts (COA), which would improve consistency, accuracy and transparency.

Integration with financial planning and analysis (FP&A)

ESG reporting is not just a data collection exercise – companies are expected to set emissions targets, track progress and plan in the same way that Finance does when preparing budgets and forecasts for financial and operational performance. It makes sense to align the two, not only for the benefit of the organisation, but also for alignment with the global sustainability agenda. The UK government has made it a priority to achieve net-zero greenhouse gas emissions by 2050 and companies are required to support this goal. FP&A teams can extend financial models and forecasts to incorporate ESG metrics, providing valuable insights into the short and long term financial implications of sustainability initiatives.

Mitigating risks and identifying opportunities

If not managed appropriately, ESG factors can have significant financial implications for organisations. Environmental risks, such as climate change and resource scarcity, can impact operational costs, supply chain resilience, and asset valuations. Social factors, such as workforce diversity and labour practices, influence employee productivity, customer satisfaction, and brand reputation. Governance factors, including board composition and ethical leadership, affect regulatory compliance, legal risks, and investor confidence.

Your Finance team has a responsibility to flag risks to the company’s financial health and can also be responsible for identifying and mitigating sustainability risks. Through a comprehensive understanding of the financial implications of ESG factors, Finance Managers can use their expertise and knowledge to make recommendations for managing the risk and securing long-term stability for the company.

Their experience also enables Finance leaders to use insights to highlight potential business opportunities which could influence strategic decision-making and financial planning. FP&A Analysts and Finance Managers play a central role in managing budgets, preparing forecasts, allocating capital, and analysing investments. By visualising the impact of ESG factors alongside the impact on cashflow and capital, organisations can spot areas of opportunity for potential cost-savings or revenue growth and react accordingly. A key example would be identifying investment opportunities in low-emission vehicles to reduce usage of fossil fuels and the carbon footprint of company vehicles, ultimately increasing returns to shareholders.

Stakeholder engagement and communication

One of the most important aspects of ESG reporting involves engaging with stakeholders, including investors, shareholders, analysts, and regulators. Investors in particular are increasingly considering ESG factors in their investment decisions. Key metrics play a central role in comparing companies within the same industry or sector, and highlight how a company performs relative to its peers. For example, in the manufacturing industry, comparing carbon emissions per unit of production helps determine which company is better prepared for the transition to renewable energy and has stronger long-term sustainability prospects, which may influence share value on the stock market. As the primary communicators of financial information, your Finance team can ensure ESG disclosures are effectively reported in the same way. Through credible reporting, the office of Finance can enhance transparency into ongoing ESG initiatives and build trust with stakeholders, helping to secure further investment opportunities.

Driving the ESG agenda

In summary, Finance teams are best suited to oversee the collection, consolidation, and reporting of ESG data alongside financial results. They bring significant expertise in data quality assurance, financial risk mitigation and reporting compliance, and can help overcome the challenges associated with ESG data management.

By assigning responsibility for ESG reporting to the office of Finance and integrating it with financial reporting, companies can not only enhance transparency and accountability, but also improve business risk management and drive long-term value creation.

Start the conversation…

Do you want to find out how to integrate ESG and financial reporting in your organisation? Find out more about how we can support you on your ESG reporting journey with a free ESG Solution Discovery!

This session involves a short collaborative workshop designed to explore your organisation’s ESG reporting needs and values:

- Scope of your ESG and sustainability information

- Applicable standards and frameworks

- ESG data collection processes

- How ESG data is controlled

- Current approaches to reporting the impact of emissions reduction initiatives

- Alignment of ESG and financial reporting

For more information, contact our expert consultants via email

Solutions

Services

Company

Contact Us

Innovation Centre 7

Keele Science Park,

Keele, Staffordshire ST5 5NL

+44 (0)203 411 0140

info@concentricsolutions.com