5 steps to optimising the virtual financial close

The uncertainty and economic impact of the COVID-19 pandemic has created an urgency to react to the disruption, catching many finance organisations off guard.

Their ability to access timely, enterprise-wide financial data was suddenly brought into question by a shortfall in contingency planning, exaggerated by any deficiencies in their financial close and reporting processes.

The fundamentals of an efficient financial close remain consistent whether managed from the office or virtually. However, a remote-working environment has introduced a greater dependency on technology. Thanks to the COVID-19 pandemic, the roadmap for a ‘fast close’ will never be quite the same.

In this blog, we take a look at how organisations can adapt to the challenges of remote-working and manage a virtual financial close.

Be agile

Finance leaders that recognise the importance of employee engagement and productivity, and the advantages of financial close automation, enable their teams to respond with greater agility during a crisis. These firms have accelerated their use of digital solutions that introduce clear end-to-end process ownership and provide seamless integration of G/L data sources, consolidation models and stakeholder reporting tools – from the cloud.

In the midst of a pandemic, this translates to more frequent reporting of cash and liquidity, the ability to model FX rate shifts, easier demand forecasting and more timely comparatives of actual results against budgets and plans.

Close faster

Optimising the financial close depends on several factors:

- the efficiency, order and timing of close activities

- keeping reported information relevant

- standardising close processes

- the use of technology to enable automation.

Those considerations can be categorised under three common headings that act as building blocks for close cycle improvement:

- The time taken to manage data collection and data loads to reporting models

- The time taken to translate, consolidate and finalise group consolidated information

- The time taken to report (to internal and external stakeholders)

Applying this framework to a virtual financial close requires understanding of a broader set of factors. Finance teams that previously operated face to face, now operate remotely, creating dependencies on IT readiness, virtual communication channels and the skills of co-workers.

The de-centralisation of the reporting process has highlighted challenges in operating models, that in many cases have extended the duration of each financial close. The COVID-19 pandemic serves only to amplify deficiencies in their close processes. Consequently, a fast close may no longer be the primary objective as some CFOs grapple with leading remote teams.

Work smarter

The need to optimise existing close cycle approaches may pre-date the current crisis, however an informed approach to finance transformation, should offer value that extends beyond the current crisis.

So, what are the tactical financial close and reporting considerations?

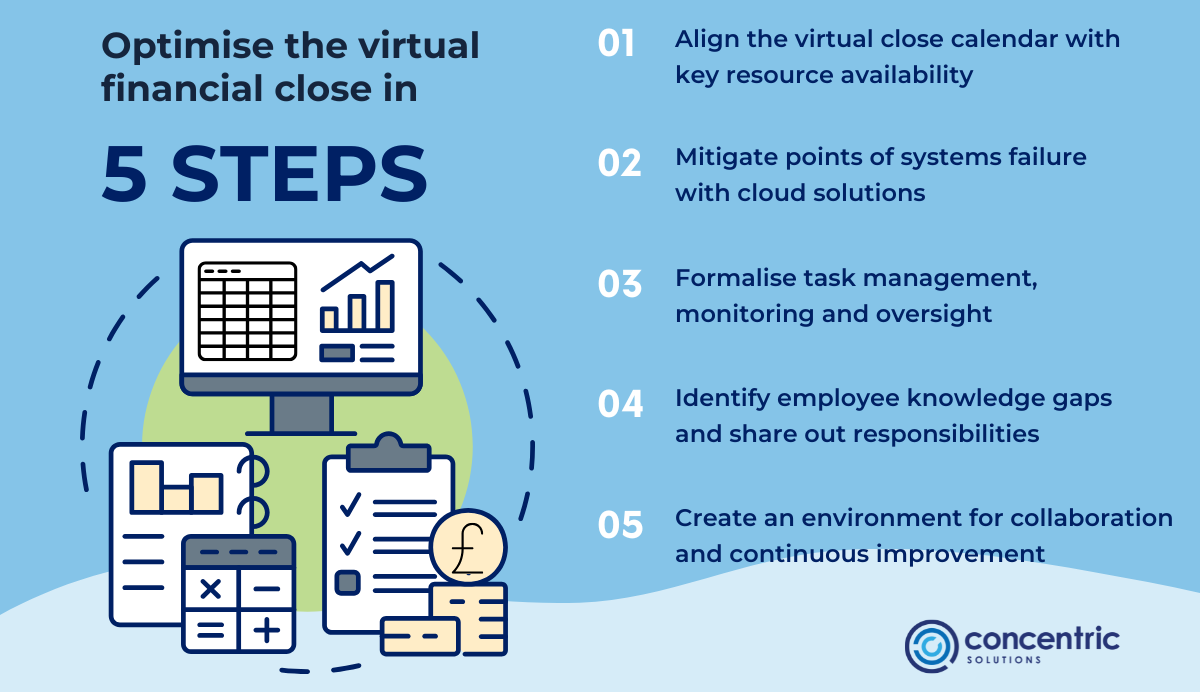

5 steps to optimising the virtual financial close:

- Align the virtual close calendar with key resource availability

- Mitigate points of systems failure

- Formalise task management, monitoring and oversight

- Identify employee knowledge gaps and share out responsibilities

- Create an environment for collaboration and continuous improvement

1. Align

A successful virtual close is dependent on collaboration across multiple systems and efficient execution of key reporting tasks at every level in the organisation. A gap assessment is critical to identifying the key knowledge workers that drive each step of the close process. Without their involvement, reliance on less experienced resources introduces risk of errors and delay. Use of centralised close calendars and reporting systems that offer role-based workflows can help guide the actions of your virtual finance team, mitigating the lack of office-based supervision.

Remote-working comes with the constraints of family life, childcare and a potential impact of illness during the pandemic. In some companies, this has meant arranging contingency resources from other parts of the organisation or outside agencies to cover for illness, staff using a backlog of accrued leave or time-zone differences during the close.

2. Mitigate

Fundamental to remote working is reliable access to systems for preparers, reviewers and administrators. Office-based staff need a laptop, suitable VPN connectivity and application security privileges to gain remote access and manage normal close activities on company G/Ls and group reporting solutions. Provision of cloud-based reporting solutions makes accessibility easier and arguably reduces the pool of contingency resources required across the business.

Video-conferencing, messaging and screen-sharing tools are critical to the finance team being able to remain in contact, and critical to them being able to provide support to each other during the close.

Replacing spreadsheets and legacy applications with integrated reporting solutions avoids maintaining data across multiple applications and databases, easing dependencies on key knowledge owners across different platforms.

3. Formalise

Modern Corporate Performance Management (CPM) applications provide end-to-end close coverage that enable tracking of sub-ledger and ledger close processes, ensure management of data quality between ERPs and reporting tools, they help automate intercompany eliminations and balance sheet reconciliations, and facilitate processing of central adjustments on consolidation. Often such activities are managed as disparate functions rather than parts of a holistic cycle.

- What are the checklists of tasks for each close-cycle, and do they differ by close? Are those checklists standardised across the business?

- Which activities are currently manual that could be automated? (e.g., data integration, account reconciliations, FX reserve calculations, intercompany eliminations, consolidation journal adjustments, tax provisions)

- Who performs those tasks and what are the storyboards for each sequence of activities? Are workflow tasks completed in the right order? (e.g. data entry tasks, validation checks, review screens/reports, adjustments, consolidations, approvals and sign-offs)

- Determine and publish the people organisation / escalation chains that ensure cover for key activities in the event of illness or holidays impacting on the close. Build in overrides to workflows that compensate for such eventualities.

- Do you have an Accounting Handbook accessible online, that maps out how to perform each close cycle ‘on system’? Consider ‘how-to’ videos that can be accessed from the financial close system or central intranet, that mitigate risk of contingency resources not being up to speed.

4. Identify

Since this remote-working approach creates distance between co-workers and makes supervision of less experienced team members an increased risk.

Systems that utilise workflows and task lists that guide the user through a series of activities offer some mitigation against knowledge gaps and inexperience. A systemic approach can also generate alerts to more senior staff and prevent governance issues from being over-looked during a virtual close.

5. Collaborate

An integrated close ‘workspace’ and close tracker, helps digitise the decisions, actions and approvals that take place at each stage. Not only do such solutions provide visibility on the close, but they also enable awareness of close cycle issues. Consistent delays each close should highlight a need for process improvement, better systems integration, or a need for user training. Peer-by-peer benchmarking across entities in the Group is a common approach to fast close improvement.

Conclusion

The secret to managing a virtual close is the design of a consistent close to report process. This includes assessment of the current reality, a risk-based approach to close cycle responsibilities and controls, and automation of repetitive tasks such as data source file transformations and validations, account reconciliations, eliminations, and consolidation adjustments. Technology is a key enabler that is critical to providing the framework for communication, user collaboration, process automation and control.

To find out more about how Concentric has helped other firms optimise their virtual financial close, complete our contact us form to request a call back.

Solutions

Services

Company

Contact Us

Innovation Centre 7

Keele Science Park,

Keele, Staffordshire ST5 5NL

+44 (0)203 411 0140

info@concentricsolutions.com